What is the #1 Success Factor for Neobanks, Digital Banks, and Challenger Banks?

What are Digital banks, Neobanks, and Challenger banks?

The names “Digital bank,” “Neobank,” and “Challenger bank” all refer to the same service. They are all “digital-only banks” that operate exclusively through digital channels, and they stand in contrast to traditional banks that also have physical branches.

Such digital-only banks are fintechs that are often compared to digital disruptors in other industries. Today, these fintechs are transforming the banking sector in a way similar to how Airbnb revolutionized the hospitality industry, or how Uber and Lyft overhauled transportation models.

Not to be confused with traditional banks that offer digital services, these neobanks provide a digital-first, digital-only, banking platform that promises seamless online experiences and low- or no-fee services.

According to recent research by Global Market Insights (GMI), the neobanking market size exceeded $45 billion during 2021 and is expected to grow significantly at a CAGR of 45% from 2022-2028.

Several factors have a very positive impact on the adoption of digital banking services

“The pandemic has demonstrated that digital banking is essential for consumers of all ages to manage their finances confidently.”

— Allison Beer, head of digital at Chase

The pandemic not only showed the necessity of digital banking services, but also dramatically shifted consumer behavior and expectations of these services.

In addition, cloud technologies, and more specifically cloud banking solutions, are the technologies that enable this major growth.

Together, the pandemic and cloud technology enabled a huge number of unserved people and small enterprises worldwide to finally get banking and financial services. They also enabled digital bank vendors to adopt “pay as you grow” business models that spread the investment over a longer period, thus allowing the business more time to achieve profitability.

The main success factor for neobanks

In this blog post, I would like to focus on the number one success factor, and its related concerns, which affects and will continue to affect this market – consumer trust in digital banking services.

Neobanks are becoming more and more popular for many good reasons. What they offer is often a more innovative and agile approach to banking, thus nurturing a real customer-centric approach. They offer not just traditional account management, but provide reliable tools that help their customers, including younger demographics, to understand their financial health and how they use their money through easy, “at their fingertips,” access.

Looking more closely at what drives the ongoing growing trend of users adopting these services, we can identify the following key contributors:

- Smartphone popularity and on-the-move data availability

- A shift in trusting digital retail experiences that require less physical interaction

- Service availability for previously unserved markets, such as remote populations, seeking financial services

Let’s see what neobank vendors developing a customer-centric approach should consider when working to strengthen trust in digital services.

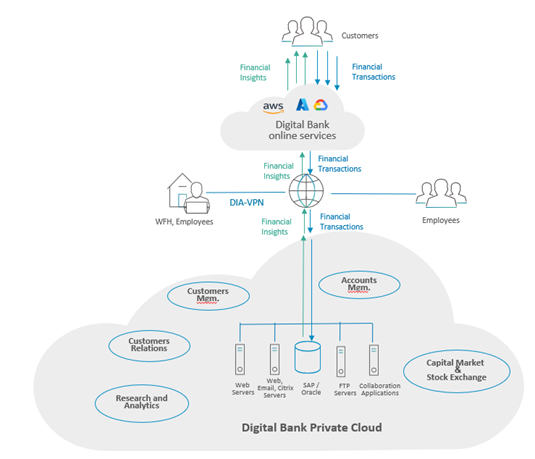

The following diagram represents a typical architecture of a neobank deployment:

As can be seen from the diagram, even digital banks have their own operational data centers operated by employees that monitor operational applications such as customer relations, account management, capital market analysis, and more.

These applications run behind the scenes to enable the advanced ‘digital only’ experience of neobank customers. Hence, service availability and high QoE are becoming very critical to the neobank vendor. Additionally, service availability is extremely vital to neobank employees, who might work from home (WFH) and access critical applications through trusted VPN connections.

Furthermore, neobank vendors must ensure they have the right visibility and control to ensure that end customers get the required financial insights through an optimized digital experience. For example, assuring an optimized number of simultaneous end-customer connections is a KPI that neobank vendors need to control, since it impacts the end users’ optimized digital experience.

For a positive customer journey, visibility & control are essential to digital bank vendors

In a recent blog post by my colleague Ami Barayev, AVP Product Management – Enterprise at Allot, the visibility and control challenges that companies experience while transitioning to the cloud were explained.

Along these lines, digital bank vendors must always have the required level of visibility and control in the cloud to be able to ensure that their consumers’ journey will continue to be positive.

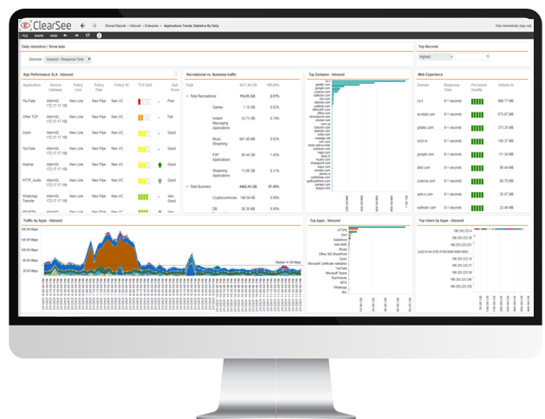

Allot Cloud Traffic Intelligence for Digital Banks provides visibility into operational applications, aligning performance with business priorities and optimizing the number of end-customer sessions to ensure an optimal experience while protecting the company’s reputation through increased customer engagement.

Backed with 20+ years of domain expertise, Allot Traffic Intelligence solutions for Financial Services maintain awareness of everything that goes in and out of the enterprise network. Allot Cloud Traffic Intelligence (ACTI) solutions extend these capabilities into the cloud environment.

Thanks to Allot’s leading granular visibility, digital bank IT professionals can gain insight into their private cloud traffic, employee behavior, and operational applications in use, while uncovering information about transaction latency. Moreover, through the ACTI graphical dashboards, IT professionals can easily understand how private cloud resources are consumed, and they can troubleshoot private cloud network performance issues.

ACTI’s advanced control capabilities enable digital bank IT departments to define real-time traffic management policies for operational applications and transaction insights. In addition, ACTI enables control of unsanctioned applications and devices, minimizes latency in DIA-VPNs, and ensures the employees’ optimized digital experience for the digital bank’s operational applications.